Encumbrance Certificate: A Comprehensive Guide

An encumbrance certificate, also known as an EC, is a legal document that certifies that a property is free from any financial or legal liabilities. It is an essential document required for property transactions, such as buying, selling, and mortgaging a property. An EC also serves as proof of clear title to a property.

This blog post will provide a comprehensive guide on encumbrance certificates, including what they are, why they are important, how to obtain them, and how to interpret them.

What is an encumbrance certificate?

An encumbrance certificate is a legal document that certifies that a property is free from any financial or legal liabilities. It is issued by the sub-registrar’s office in whose jurisdiction the property is located. An EC contains a record of all registered transactions related to the property, such as sale deeds, mortgage deeds, and gift deeds. It also includes information about any encumbrances on the property, such as liens, easements, and leases.

Why is an encumbrance certificate important?

An encumbrance certificate is important for several reasons. First, it helps to protect buyers from purchasing property with hidden encumbrances. For example, if a property has a lien against it, the buyer may not be able to transfer the title of the property until the lien is cleared. Second, an EC is required by banks and other lenders before they can sanction a loan against a property. This is because lenders want to ensure that the property is free from any encumbrances before they lend money against it. Finally, an EC may also be required for certain government transactions, such as mutation of property records and obtaining building permits.

How to obtain an encumbrance certificate

There are two ways to obtain an encumbrance certificate: online and offline.

Online:

To obtain an EC online, you can visit the website of the sub-registrar’s office in whose jurisdiction the property is located. Most sub-registrar’s offices now offer online services for obtaining ECs. You will need to create an account on the website and provide some basic information about the property, such as the survey number and the owner’s name. Once you have submitted the required information, you will be able to download the EC in PDF format.

Offline:

To obtain an EC offline, you will need to visit the sub-registrar’s office in person and submit an application form. You will also need to pay a processing fee. The application form will typically require you to provide the following information:

- Survey number of the property

- Owner’s name

- Period for which you require the EC

The sub-registrar’s office will process your application and issue you an EC within a few days.

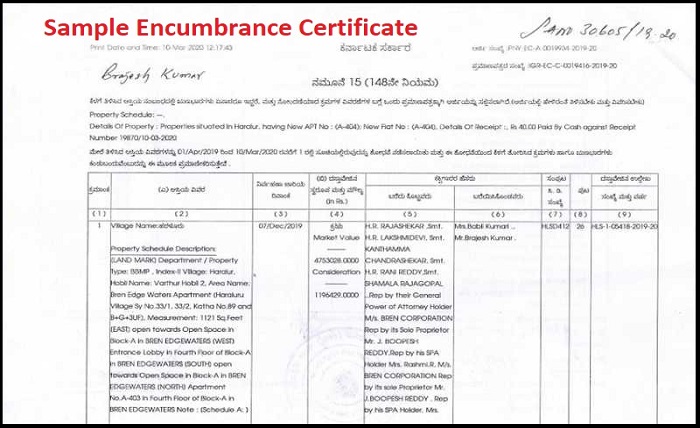

How to interpret an encumbrance certificate

An encumbrance certificate is typically divided into two parts:

- Part I contains information about the property, such as the survey number, the owner’s name, and the area of the property.

- Part II contains information about any encumbrances on the property.

Encumbrances are typically listed in chronological order, with the most recent encumbrance listed first. Each encumbrance will typically include the following information:

- Type of encumbrance (e.g., lien, easement, lease)

- Date of registration

- Name of the encumbrance holder

- Amount of encumbrance (if applicable)

If the property has no encumbrances, Part II of the EC will be blank.

Conclusion

An encumbrance certificate is an essential document required for property transactions. It is a legal document that certifies that a property is free from any financial or legal liabilities. Buyers, sellers, and lenders alike should always insist on obtaining an EC before entering into any property transaction.

FAQs

Q: What is the difference between Form 15 and Form 16 encumbrance certificates?

A: Form 15 is issued when the property has encumbrances during the time period for which the EC is requested. Form 16 is issued when the property has no encumbrances during the time period for which the EC is requested.

Q: How long is an encumbrance certificate valid?

A: An encumbrance certificate is valid for six months from the date of issue.

Q: What should I do if I find an encumbrance on my property?

A: If you find an encumbrance on your property, you should first try to contact the encumbrance holder to resolve the issue. If you are unable to resolve the issue directly with the encumbrance holder, you may need to seek legal assistance.

Q: Can I obtain an encumbrance certificate for a property that is located in a different state?

A: Yes, you can obtain an enc