Indian Oil Corporation (IOCL) Share Price: A Comprehensive Analysis

Indian Oil Corporation Limited (IOCL) is the largest public sector oil and gas company in India, with a market capitalization of over ₹1.5 trillion. The company is engaged in the refining, marketing, and distribution of petroleum products, and also has a presence in the petrochemicals and exploration and production sectors.

IOCL is a major player in the Indian economy, and its share price is widely followed by investors. In recent years, the company’s share price has been on a roller coaster ride, reflecting the volatility in the global oil and gas markets.

Factors Affecting IOCL Share Price

A number of factors can affect IOCL’s share price, including:

- Global oil and gas prices: IOCL’s revenue and profitability are directly linked to global oil and gas prices. If oil and gas prices rise, IOCL’s profits will increase, and its share price is likely to rise as well. Conversely, if oil and gas prices fall, IOCL’s profits will decline, and its share price is likely to fall as well.

- Indian economy: IOCL’s performance is also closely linked to the performance of the Indian economy. If the Indian economy is growing, IOCL’s demand for petroleum products is likely to increase. Conversely, if the Indian economy is slowing down, IOCL’s demand for petroleum products is likely to decline.

- Government policies: The Indian government has a significant influence on the oil and gas sector, and its policies can have a major impact on IOCL’s share price. For example, if the government increases taxes on petroleum products, IOCL’s profits will decline, and its share price is likely to fall as well.

- Company-specific factors: In addition to the macro factors mentioned above, a number of company-specific factors can also affect IOCL’s share price. These include the company’s financial performance, its investment plans, and its management quality.

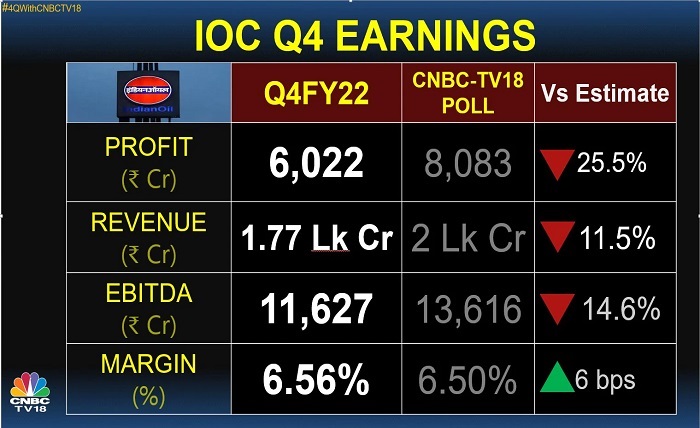

IOCL Share Price Performance in Recent Years

IOCL’s share price has been on a roller coaster ride in recent years, reflecting the volatility in the global oil and gas markets. In 2014, IOCL’s share price reached an all-time high of ₹700. However, the share price fell sharply in the following years due to the decline in global oil and gas prices. In 2016, IOCL’s share price fell to a low of ₹250.

The share price has since recovered somewhat, but it is still significantly below its all-time high. In November 2023, IOCL’s share price is trading at around ₹350.

Outlook for IOCL Share Price

The outlook for IOCL’s share price in the coming years will depend on a number of factors, including the performance of the global oil and gas markets, the Indian economy, and government policies.

If the global oil and gas markets remain volatile, IOCL’s share price is likely to remain volatile as well. However, if the global oil and gas markets stabilize, IOCL’s share price is likely to rise.

The Indian economy is expected to grow in the coming years, which should support demand for petroleum products and boost IOCL’s performance. However, if the Indian economy slows down, it could have a negative impact on IOCL’s share price.

The government of India is likely to continue to implement policies that support the growth of the oil and gas sector. This could be positive for IOCL’s share price.

Overall, the outlook for IOCL’s share price in the coming years is mixed. The share price is likely to remain volatile in the short term, but it could rise in the medium to long term if the global oil and gas markets stabilize and the Indian economy continues to grow.

Investment Advice

Investors who are considering investing in IOCL should carefully consider the factors that can affect the company’s share price. Investors should also carefully consider their own investment goals and risk tolerance before making any investment decisions.

Conclusion

IOCL is a major player in the Indian oil and gas sector, and its share price is widely followed by investors. The share price is likely to remain volatile in the short term, but it could rise in the medium to long term if the global oil and gas markets stabilize and the Indian economy continues to grow. Investors who are considering investing in IOCL should carefully consider the factors that can affect the company’s share price, as well as their own investment goals and risk tolerance.